Westpac is a major New Zealand bank serving over a million customers, and has been operating in New Zealand since 1817. In 2014, SilverStripe collaborated with Westpac’s in-house developers and other vendors to create Westpac One – a single platform to deliver all consumer banking services online, replacing previously disparate applications that were costly and slow to improve.

Using Agile methodologies, SilverStripe worked with Westpac’s development teams and other vendors to deliver an award-winning portal that was created, tested and launched in less than two years. An early beta version was released to a select group of users across all devices in just three months. Westpac’s full suite of over 120 services launched to all customers just over a year later.

The Challenge

While banking itself is an old institution, the industry constantly finds itself having to adapt to a rapidly changing online environment. In particular the rapid growth in mobile use has required a total rethink of website functionality and delivery.

As one of New Zealand’s largest banks, Westpac naturally had an internet banking application, however their existing IT infrastructure and processes restricted its ability to innovate. The layers of compliance and processes that had been added over 15 years of Westpac’s online banking application had restricted their digital marketing and IT departments’ capacity to quickly deliver new products in the online space.

Westpac’s Chief Digital Officer Simon Pomeroy said there were two main considerations.“We wanted the customer to be at the heart of our digital strategy, compared to having technology for technology’s sake. Until then, we had a disparate digital strategy, with components built on components.” For example, Westpac had an app for Android, an app for iOS and an app for tablets (among many), rather than a platform on which to provide its services to all and any devices. Westpac One sought to create a single platform to bring all online banking applications together.

“If we went to build something new on our old system, it was costing four to five times what it should, and taking four to five times as long,” Pomeroy said. “We took the simple view, why not do it once, properly, and build a platform from which we could control all the other processes.”

If we went to build something new on our old system, it was costing four to five times what it should, and taking four to five times as long...

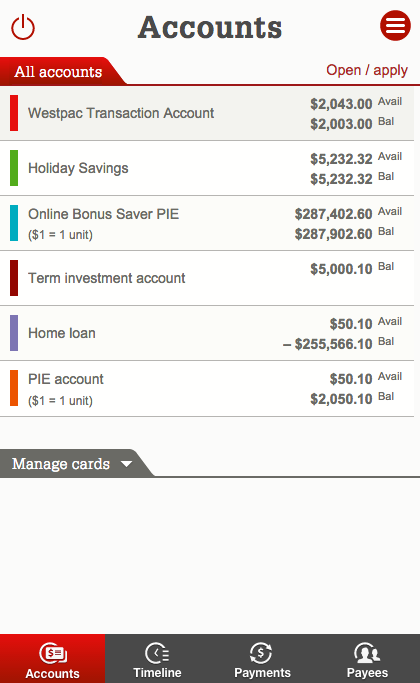

Before the Westpac One project began, customers could access 80% of the bank’s total offering from a desktop, however only 60% of its services could be carried out on a tablet and 40% on a smartphone. The remit was to create a web presence that allowed real-time interaction no matter how it was accessed. It was paramount that any changes to the website’s usability had to have a 100% protection of user information and the security of their transactions.

“This sounds simple, it is a simple strategy, but it is a complex build,” said Pomeroy. Our solution was to retire apps that weren’t fully scalable. We wanted ways of working that were fully responsive and device agnostic.”

Why choose SilverStripe?

Westpac had worked with SilverStripe on its successful public website relaunch in 2012. When it came time to redevelop their online banking services, they again chose to partner with SilverStripe. Agile methodologies were core to delivering successful, customer centred solutions in both cases.

SilverStripe strongly believes the Agile approach results in better value for clients and superior online experiences for customers. Agile teams create small, usable features and then user feedback loops to manage complexity and risk. This stresses decision making from real-world results rather than from speculation.

This project required SilverStripe's world-class capability, along with their willingness to call things out.

“Ours is also a relationship that is built on honesty and trust,” Pomeroy said. This project required SilverStripe's world-class capability, along with their willingness to call things out.

We won’t always see eye to eye, but like any relationship that is honest, those are the types of conversation we can have. It is an aspect of our relationship that we really appreciate.”

The Agile methodology makes continuous learnings is an inherent part of product development. By using Agile for the Westpac One project, it was possible to learn and adapt as features were rolled out. This ensured the end result not only succeeded in delivering the business goals, it also exceeded customer satisfaction targets.

The Solution

Westpac wanted to leapfrog its competition rather than just keep pace with it. This required SilverStripe to greatly reduce the time to deliver such a complex technology project. Westpac’s goal was to produce a scalable, optimised for any device, online customer experience where verification was easy and all services were available.

Proving Agile benefits

The first deliverable was a Proof of Concept (PoC) - a working model and design of Westpac’s vision for a new internet banking concept. This started with smartphones as the first device to be redeveloped, and then working backward to desktop accessibility. The PoC was delivered in just two weeks. The speed and immediate value created proved that the Agile approach was going to deliver the results.

Create, test, improve

The massive Westpac One project was divided into small feature led releases. This allowed software to get into the hands of users quickly, allowing for continual feedback and improvements. The initial user-testers were Westpac staff. They evaluated, tested and provided feedback. As the website’s new services and products were incrementally improved, after three months the bank released a beta version to selected customers, and then to more and more of its customers every three months.

“This provided us with the ability to test and learn,” said Pomeroy. “We were able to optimise Westpac One based on customer feedback. In 18 months we created the new platform that was officially launched at the beginning of 2015”.

After each release, Westpac and SilverStripe would review how the previous months’ development had gone. They then adapted their processes to improve the delivery model. This ‘rolling’ adoption, meant SilverStripe could identify constraints, working with the ones not able to be changed, while removing many that could. The project grew from one stream of work in the first release, to five cross-functional teams working together on streams of work in release four.

One project, one team

The project was led end-to-end by a Westpac Project Manager and two SilverStripe Scrum Masters (facilitators for the product development team). Running this full ‘Scaled Agile’ approach was the key to managing a project that had over 120 people working on it at its peak.

We had the confidence that they had the expertise and could carry out a mobile-first strategy...they were part of the Westpac team, and we succeeded as one team.

It was a team approach with Westpac’s developers concentrating mostly on the internal system integration and SilverStripe on the front-end design elements and integration points between, Pomeroy said. "SilverStripe had done similar projects within other industries and we had the confidence that they had the expertise and could carry out a mobile-first strategy. Right from the start we had SilverStripe onsite. It was never an agency relationship, they were part of the Westpac team, and we succeeded as one team.”

Shifting mindsets to embrace Agile

The Agile approach removes silos across the many roles required for web projects. Instead of a traditional project management approach, in which front-end and back-end development teams work together, coming together at the end of a process, Agile creates small cross-functional teams. Tony Dale-Low, Scrum Master for eight months of the Westpac One project says Agile deliberately creates a more natural, collaborative way of mixing skill sets – across designers, developers, testers and business analysts.

Dale-Low is confident that Westpac One would not have been as successful as it is without Westpac adopting Agile for the project. “Agile allows you to deliver in a timeframe, it is quicker, its output is much faster,” he says. “But while Agile is a start point, the framework to follow, the process is just as important. So is the mindset required.”

Agile can be simple in theory, but challenging in practice, he says. Part of what SilverStripe delivers through its approach to Agile is helping clients adjust their own mindset in how projects can be delivered through collaboration and continuous improvement.

The incremental nature of Agile is key. “You break down the project so you deliver something of value early. With Agile you build up the product, add the next piece of value, attach what's important for customers. Where you think you're going may not be where you end up. Customers and business change all the time. The process of Agile is designed to adapt more than the traditional project management approach.”. In the fast-paced digital world, an Agile mindset rather than a fixed plan is critical.

Learn 8 principles of digital transformation in banking

The Results

Agile methodology enabled Westpac to achieve its goals. The teamwork, collaboration and adaptability of the Agile approach meant that the Westpac One project gathered and maintained momentum, delivering a complete overhaul of the bank’s online banking functionality in less than two years.

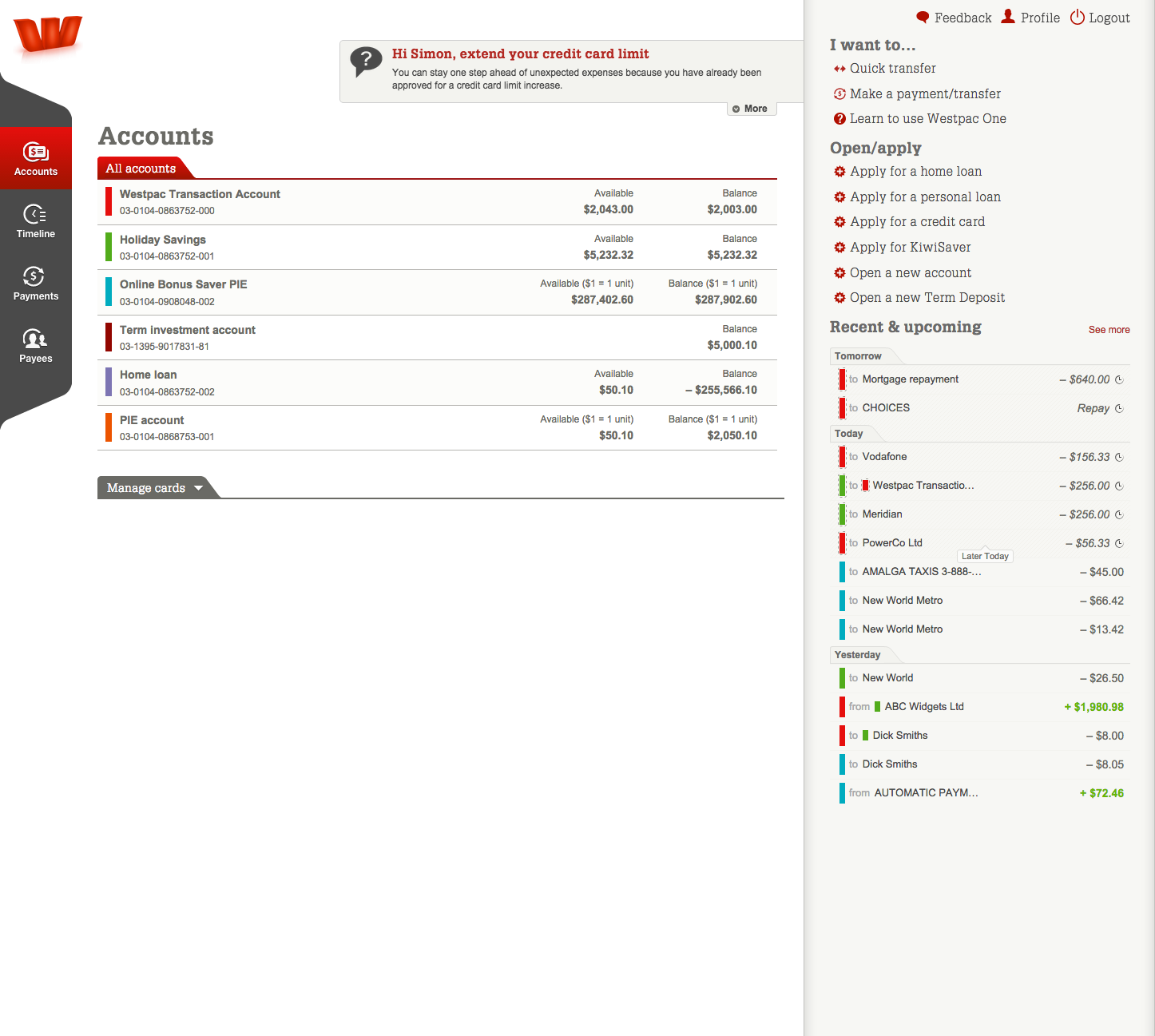

This was significantly faster than a traditional five to seven-year creation and deployment timeframe which would have been required in previous decades. Westpac One now offers fully integrated options to apply online for accounts, loans, credit cards and term deposits. Customers can search and filter payments across accounts, using past, current and future timeframes through the site’s unique ‘Timeline’ feature.

Across all devices, mobile, tablet and desktop, usage went up nearly 30%

“Under our new device-agnostic website structure, Westpac customers can carry out actions such as apply for a home loan or credit card online. We can then use our Westpac team to follow up and see if it is all going well.”

Another indication to Westpac that its new online banking platform and its functionality is on target is the total online usage. “Across all devices, mobile, tablet and desktop, usage went up nearly 30%,” he says. It shows that because accessing our services is quicker and easier, people are using Westpac One more.”

Westpac One was quickly recognised as the new benchmark for online banking. Independent research company Canstar awarded Westpac One “The Best Online Banking 2015”. Mitchell Watson, Canstar research manager says “This platform topped the scores in almost all online banking and website features we reviewed to provide a user-friendly online banking service.”

SilverStripe helped Westpac created an award-winning digital banking experience that is market leading. It provides a scalable platform that enables banking services to be built in an agile manner that is responsive to the needs of customers.